|

Getting your Trinity Audio player ready...

|

A world is created where transactions take place within seconds without cash or cards but only a tap of the phone. Split bills, pay business payments, and send money around the world all thanks to payment applications that are creating a revolution in finance and transaction management. In fact, as the trend goes, payment apps may manage to meet or at least bring down the quality of expectations that both businesses and users have when it comes to speed, safety, and convenience. What does it take to create just such an app?

EsferaSoft specializes in developing secure payment solutions that are friendly and easy to use. Payment app development is not just code writing; it is the preparation of a frictionless experience that users trust. Cutting-edge security features and intuitive designs complement each other to create an exceptional user experience. Not just the appeal or convenience of the app, but every feature in between from biometric authentication to real-time fraud detection to the app plays a critical role in ensuring security and ease of use. We will take you through the complete journey-from ideation to launch-unraveling what makes it secure, efficient, and future-ready in a payments app.

Creating a Payment App: Where to Begin?

Building a payment app is not just about coding; it’s about designing a seamless experience that users would trust. Whether you are developing a white-label payment app solution or a fully customized one, taking the right steps at the outset is crucial. This document is a step-by-step breakdown that sets you on a way to success.

1. Define Your Purpose & Target Audience

- Who will use your app? Businesses? Individuals? Or both?

- Will it be used for peer-to-peer (P2P) transfers, merchant payments, or all three processes, including crypto transfers?

- Only when you know the audience can you develop the features, security, and overall design.

2. Choose White-Label or Custom Development

- Solutions for payment apps that are white-label: swift and cheap, but very limited in customization.

- Custom mobile payment apps give you complete control over what features they can incorporate and how they brand themselves, although such apps demand a bunch of investment as well.

- It’s dependent on the business vision of the company and budget.

3. Compliance and Security from the First Day

- Processing payments safely requires compliance with PCI-DSS.

- Implement encryption, two-factor authentication, and AI fraud detection to help users develop confidence.

- Short-cutting security ultimately leads to breaches and loss of reputation in the eyes of the customers.

4. Plan your Features for Maximum User Engagement

- Must-have basics: Safe logins, transaction history, real-time notifications

- Advanced features: Biometric authentication, cryptocurrency payments, AI-driven budgeting

- Every feature should speak convenience while maintaining security.

5. Choose the Best Payment GateA wellway Integration

- A well-defined payment gateway allows you to complete transactions with different payment methods without any hassle.

- Different payment methods include PayPal, Stripe, Square, and custom APIs. All have their pros and cons regarding costs and advantages.

- The right gateway minimizes failed transactions and maximizes revenue.

6. Build for Scalability and Future Growth

- A cloud-based infrastructure is to be selected for better performance and flexibility.

- Cross-platform compatibility (iOS, Android, web) would allow the payment app to reach more users.

- The payment app must evolve with developing technologies in AI, blockchain, and contactless payments.

Cost vs. Value: What Goes Into Payment App Development?

Everyone knows building a payment app is so much more than a price tag; it’s value. Costs can vary depending on features, as well as security and integrations, but a well-built app could change the way businesses transact. Let’s discuss the main cost to develop a payment app and their worthy investment.

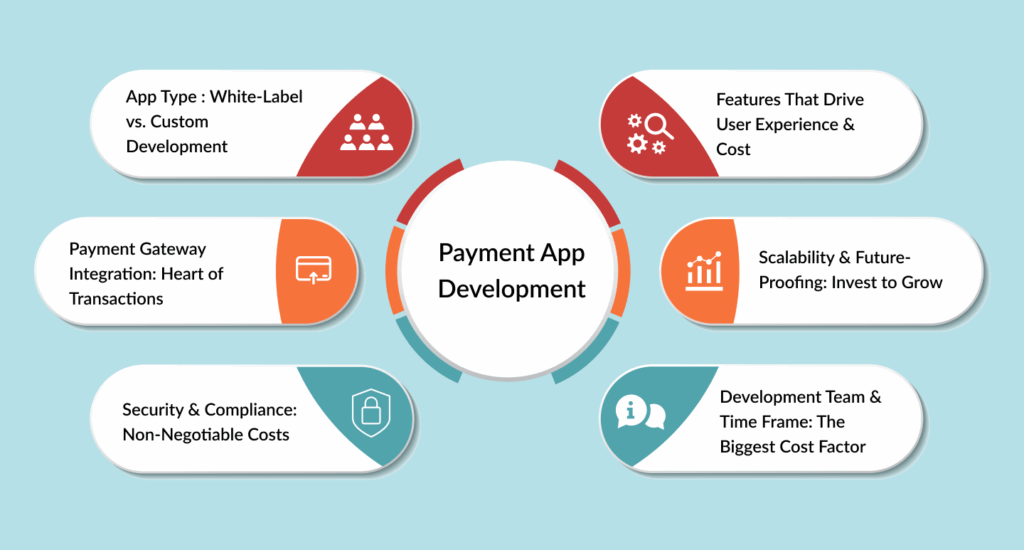

1. App Type: White-Label vs. Custom Development

- Custom mobile payment apps allow for individualized experiences with unique branding but will require a heftier upfront investment.

- White-label payment app solutions are much faster and cheaper but are limited in terms of customization.

- Cost-saving or long-term scaling would be the determiners of choosing one over the other.

2. Payment Gateway Integration: Heart of Transactions

- Integrating multiple payment gateways will give customers flexibility in choosing payment methods.

- Admittedly, that would depend on the transaction costs of the popular ones like Stripe, PayPal, and Square.

- The strong investment would lessen customer dropped transactions while increasing customer confidence.

3. Security & Compliance: Non-Negotiable Costs

- PCI-DSS, encryption, and fraud detection add to the development costs but are some of the most important components in the protection of user data.

- Furthermore, biometric authentication, two-factor verification, and AI-based fraud monitoring have advanced technology in the incorporation of their security.

- Avoid taking shortcuts in this situation, as a security breach could result in significant costs and undermine user trust.

4. Features That Drive User Experience & Cost

- Basic features: User registration, transaction history, and notifications keep development costs lower.

- Advanced features: Artificial intelligence-fueled expense-tracking systems, along with the ability to pay with cryptocurrencies and P2P transfers, add value to the app but also increase costs.

- It is necessary to evaluate and choose each feature considered to maximize usability versus cost.

5. Scalability & Future-Proofing: Invest to Grow

- Scalability refers to the architecture of the application’s ability to accommodate user and transaction growth.

- Despite their higher initial implementation costs, cloud-based solutions offer flexibility and long-term cost efficiencies.

- Regular updates and maintenance keep the costs from exploding, as well as keep the application competitive.

6. Development Team & Time Frame: The Biggest Cost Factor

- Costs for the entire project will be mainly influenced by the team of developers, be it internal or outsourced.

- More investment into resource development means faster turnaround times, most likely reflected in the budget as well.

- Having a well-planned roadmap helps keep expenditures in check while ensuring high-quality development.

Maximizing ROI: How to Ensure Your Payment App Pays Off

1. Choose the Right Payment Model

- Transaction costs would be a small percentage of every transaction done by businesses or merchants.

- Subscription Plans: Post a fee every month for outstanding features such as immediate money transfer, analytic features, or multiple currency support.

- Partnerships & Licensing APIs: Earn by allowing third-party apps to merge with your payment solution.

- Interchange Revenue: Money earned from interchange fees related to debit or credit card transactions within the application.

2. User Experience (UX) Comes First for Retention

- Speedier Transactions: Processing speed should be improved such that users do not turn to a competitor.

- Seamless Onboarding: Having biometric logins and rapid verification removes friction during registration.

- Personalized Enhancements: Spend insight, bill notices, and cashback offers. All these will be powered by AI and thus improve engagement.

- Customer Support: Covers the spectrum: 24/7 AI chatbot + human support. This feature improves trust and loyalty.

3 Seal the Deal by Investment in Security & Compliance-Trust is Profit

- User Transaction Safety: PCI-DSS compliance and solid encryption keep transactions safe.

- AI Fraud Detection: Prevent chargebacks and unauthorized transactions from happening through AI-powered fraud detection.

- User Security: 2FA & Biometric Logins give the users peace of mind that they can use your app safely.

4. Data Analytics for Deciding

- Use AI-powered insights to trace spending patterns and user behavior.

- Attract customers by offering tailor-made financial tools like budget assistants and expense tracking.

- There has been innovation in A/B testing of features and UI changes to boost the conversion rates.

5. Long-Term Growth through Investment

- Open into new markets: offering multi-currency and cross-border payments.

- Corporate clientele by way of business solutions like invoices and payroll integration. For example, improve contactless and wearable technologies (NFC and QR codes).

The Future of Payments: Turning Innovation into Profit

Building a successful payment app isn’t just about transactions—it’s about creating a seamless, secure, and scalable experience that users trust. From choosing the right monetization model to prioritizing security and user experience, every decision plays a role in ensuring your app’s profitability. By investing in cutting-edge features, data-driven insights, and strategic growth, your payment app development can meet current market demands and lead the future of digital finance. Are you prepared to revolutionize the way payments operate with EsferaSoft? The time to innovate is now; call today at +1 307 2220456!