|

Getting your Trinity Audio player ready...

|

The peer-to-peer (P2P) payment market is set to explode in 2025, as global transaction volumes are expected to reach more than $10 trillion owing to consumer demand for easy, instant transfers of money. An increasing number of users are becoming frustrated with the high fees, delayed settlements, and fragmentation among payment apps and financial services.

The Clone Cash App is designed to address all of these evolving needs. The modern wallet product combines instantaneous transfers, embedded investing, and financial utilities under one product, beating rival competitive products in the market. Low-cost, instant P2P transfers are encouraged by consumers, financial inclusion in underserved markets, and the demand for integrated services without app changes are some of the drivers of this effect.

From a business perspective, there are numerous channels for growth: partnering with banks to meet regulations and facilitate a quick flow of transactions; collaborating with merchants to ensure both online and in-store payments; and reaching unbanked regions to increase customer demand, particularly in developing countries. Customers without bank access tend to make it easier to monetise by combining payment flows with investment features and fiat-to-crypto conversions.

Your Cash App clone can establish itself as a next-gen fintech brand by offering some serious digital wallet functionalities, such as quick rails between developed financial services and social features, and adapting to those realities in terms of what’s coming and future-proofing your offer for an evolving landscape in digital finance.

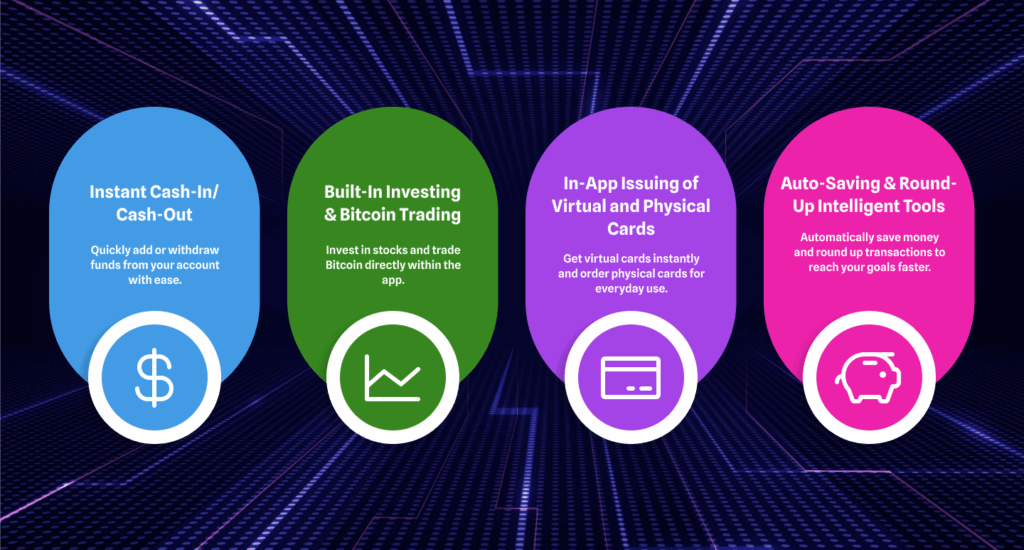

Core Differentiators & Value Drivers

In the competitive market, it is differentiation that defines success. An excellent Cash App clone could take that differentiation:

- Instant Cash-In Cash-Out: Users are used to immediacy. Hence, the app will integrate instant payment systems, such as RTP (in the United States), Faster Payments (in the United Kingdom), and UPI (in India), that allow real-time debit card fund withdrawal, ensuring that the resources are always available. Zero-conduits would elevate user confidence and use.

- Built-in Investing & Bitcoin Trading: Investing leftover coins, allowing users to buy fractions of investments and cryptocurrencies directly, is a built-in feature. Micro-investing, portfolio diversification, and crypto access all throw themselves into the movement of social money by incorporating functions such as payment storytelling, animated cash envelopes, and social requests for payments. Feed transactions with comments-reactions-visual highlights, encourage engagement, notifications, and organic growth virality.

- In-app issuing of virtual and physical cards: To create a virtual card immediately using such rich templates, associate with companies that issue plastic cards, such as Marqeta and Stripe Issuing, and place an order to have their branded cards produced. Such an advancement opens up the use of online, subscription, and day-to-day retail payments while generating income from interchange fees.

- The Auto-Saving and Round-Up Intelligent Tools: Round up one time automatically (nearest rupee/dollar) and move into savings or investment buckets. This feature ensures that users automatically develop savings habits without needing to worry about saving money, as it intelligently differentiates between competitive offers.

These features change the app from being a simple payments tool to a complete user’s personal finance centre: instant gratification, social interaction, and embedded financial services – making money via transaction fees and charges, investments, and savings methods.

Feature Prioritisation for MVP & Rapid ROI

Quick launches do wonders in getting traction and validation for the idea. Prioritise impactful essentials, maximum user value, and revenue potential:

1. User onboarding & KYC automation

Rapid account creation is achieved through OCR ID scanning, selfie-based verification, and automated e-KYC processes that ensure compliance while minimising friction. This process reduces onboarding drop-off rates and allows verified users to begin transacting within minutes.

2. P2P Transfer and QR Code Payments

Enable instant peer transfer through either the phone number, email alias, or dynamic QR code. The system supports both P2P transfers and in-store QR scanning, which are critical for daily transactions and viral distribution.

3. Balance Management & Transaction History

Real-time updates of the wallet balance and automatic categorisation of transactions (food, transport, rent), allowing data exports (CSV, PDF) for keeping track of personal finance. Transparency improves trust and usability.

4. Referral and Rewards Engine

Encouraging growth will be achieved through a built-in referral system that offers sign-up freebies, cashbacks, and token rewards. The app will monitor referral links and credit bonuses when the conditions are met, motivating continuous sharing.

5. Customer Support Chatbot

An AI-powered chatbot handles 24/7 enquiries, disputes, and transaction status, escalating them to human agents when necessary. This improves user satisfaction while lowering support costs.

This MVP core can be launched over 12-16 weeks, with a lean team and focused budget. Inflows from the first transaction and referral fees can begin soon after this. A phased rollout ensures a return on investment early in the game and builds in a cycle of continuous optimisation, laying the groundwork for advanced features: investing, issuing cards, merchant SDKs, and high-value financial services.

Payment & Banking Integrations

Integrations grant a seamless financial flow across payment pipelines while providing user trust with the payment rails:

- Core Banking APIs: Connect to national payment infrastructures, like ACH (U.S.), SEPA (EU), Faster Payments (U.K.), or UPI (India). Also support real-time rails like FedNow or IMPS/NEFT. The system can facilitate inbound and outbound transfers, wallet top-ups or cash-outs, with minimum fees and maximum speed.

- Card Issuance & Processing: This system is adaptable for integration with fintech processors such as Marqeta, Stripe Issuing, or Visa Token Service, allowing for the instant provisioning of virtual and physical debit cards.

- Crypto Exchange Integration: Partner with a regulated crypto exchange or licensed off-ramp provider that facilitates in-app purchases with Bitcoin or stablecoins. Secure APIs should enable the user to convert their fiat to crypto and back, increasing stickiness and fulfilling an increasingly growing crypto need in 2025.

- Bill Pay and Merchant SDKs: Integrate bill pay functionalities (utilities, mobile top-ups) and merchant SDKs or POS terminals to perform in-store payments. This integration expands the app’s features beyond peer-to-peer (P2P) transactions, creating a full-service wallet ecosystem.

This integration will provide not only the typical wallet functionality but also lay the groundwork for future growth in areas such as sending money internationally, issuing loyalty rewards, cross-border payments, and partnerships with other financial services.

Security & Compliance Blueprint

Security is mandatory; it is neither an option nor an alternative, and it is imperative for user trust and regulatory approval.

- Compliance with the PCI DSS and SOC 2-chequered framework: It features the operation of your online platform in secured, certified environments. PCI DSS protects cardholder data, while SOC 2 Type II certification verifies your controls around availability, confidentiality, and integrity.

- AML and KYC Enforcement: Multi-layered identity verification with real-time whitelist/blacklist screening, sanction checking, and automated risk scoring. In addition, continuously monitor transactions to detect suspicious behaviours or possible money laundering.

- Encryption & Tokenisation: Always encrypt user & transaction data in static and mobile terms. Tokenise card data so that internal systems see only tokens, thus reducing PCI risk exposure.

- Fraud Detection Models: Use AI/ML models for behavioural analytics in case of observing unusual activity patterns, velocity spikes, or compromised credentials. Make automated risk scoring possible, along with real-time alerts, pending review and a hold on the transaction.

The precautions taken safeguard both users and your platform. This establishes the credibility and compliance of your clone in terms of safety; making it from day banks, regulatory bodies, and partner institutions, you will be required to provide evidence of proactive controls and automated risk management.

UX/UI Experiences for Engagement

Create an open and inviting space with a sleek, engaging interface; this strong investment in UX/UI design will encourage users to return repeatedly.

- Intuitive Transaction Flow: Sending or requesting money should always take three taps or fewer. Use clear, consistent visual cues and progressive disclosure – only show it when it matters.

- Insights into Personal Finance: The way to empower users to make better decisions is by providing very useful automated insights, such as breakdowns of spending, budget categories, savings growth, and monthly trends. Add goal setting and push notifications around milestones, for example, when they reach certain expense thresholds.

- Customisable interface themes: Allow users to customise their experience in the app; there are vibrant colour themes to choose from and the ability to switch between day/night modes. Add widgets for quick actions (Send, Pay, invest) for speed and familiarity.

- Accessibility standards: Include support for screen readers, voice-activated payments, high-contrast UI modes, and scalable typography. This promotes inclusive access to users with disabilities while also improving adherence to regulations (e.g., ADA, WCAG).

The design elements that enhance user experience – such as, for example, money transfer animations, simple, clear iconography, and no cognitive load – go hand-in-hand with higher retention rates, enhanced activation rates, and greater word-of-mouth referrals. Fintech users want both beauty and function.

Pilot Program & Proof‑of‑Value

A structured pilot tests assumptions and sharpens product-market fit:

- Pilot Cohort Selection: This should be one of the user groups most affected by the pain points—freelancers, daily wage workers, gig economy workers, or other under-represented sectors. If the services prove to be useful, they are likely to adopt them quickly.

- Key Metrics: Collect adoption rate (percentage completing onboarding), transaction frequency (average per day or per week), referral lift (signups coming from existing users), and support enquiries (volume and resolution time). Monitor their flags for possible fraud and completion of KYC.

- Timeline: The entire process will take 6-8 weeks, which includes 1-2 weeks for setup and recruitment, 3-4 weeks for live testing, and finally 1-2 weeks for gathering feedback and making iterations.

- Scaling Strategy: Automating the onboarding flows based on results from the pilot, enhancing the fraud transport logic, and extending the payment rails (e.g., additional bank integrations or card networks) in accordance with the results from the pilot. Take lessons to improve products, the tone of the marketing message, and technical scaling.

A successful pilot provides real, data-driven proof of value, fuelling investor confidence, partnership discussions, and internal decision-making regarding the full feature rollout.

Monetisation & Growth Framework

Sustainable scaling creates a revenue model that applies to various services:

- Interchange & Transaction Fees: Negotiate small fees as a percentage on each transfer or card payment. On P2P, fees can stay minimal (say 0-1% consumer-side level), while interchange from card spending could generate backend revenue via the spread with the issuing banks.

- Subscription Tiers: Have voluntary premium plans. Premium users could have zero-fee instant cash-outs, higher transfer limits, better investment tools, and priority support.

- In-App Financial Services: Monetise by disbursing microloans, round-up pocket investments, savings products, and managed portfolios, each with its own fee structure (interest spreads, advice fees, and management fees).

- Merchant Partnerships: Bring merchants into loyalty and cashback programs. Advertise merchants’ offers within the application – earn referral commissions and create cross-promoted campaigns.

Through this diversified monetisation circle (interchanges, subscriptions, financial services, and merchant commissions), the platform is profitable even while keeping consumer-side type fees at the competitive level. Support growth marketing through referral engines and social payment features, increasing volume simultaneously while keeping it cheap.

Technology Stack & Architecture

Business Growth is Driven by a Robust, Scalable, Resilient Technological Backbone

- Mobile Platforms: For building faster cross-platform iterations, React Native is the option. Although performance at its best can be achieved through Swift (iOS) and Kotlin (Android), which is especially critical for biometric onboarding, camera scanning, and encryption layers.

- Microservices Backend: Build a microservice with Node.js or Go and deploy their services on a container orchestrated by Kubernetes to allow independent scaling per component (i.e., onboarding, payments, fraud detection, wallet ledger).

- Databases: An ACID-compliant SQL database should be used to store transactional data (Postgres, MySQL, CockroachDB) for ledger integrity. Use NoSQL (mongodb, Redis) only for session storage, caching, and real-time lookup requirements.

- Event Streaming & Messaging: Kafka or RabbitMQ. Event real-time notification sending, service synchronisation, compliance workflow triggering, and analytics pipeline.

- Cloud & DevOps: On AWS or Google Cloud Platform. Make use of serverless functions to handle peak load spikes (e.g., Lambda, Cloud Run). Build CI/CD pipelines, infrastructure as code (Terraform), automated testing, and observability (Prometheus, Grafana, Sentry) to ensure reliability and quick iteration.

This architecture guarantees 24/7 operational security, facilitates easy scaling to localities, ensures clear security measures, and provides the agility needed to accommodate new demands such as rural financial services or remittances, DeFi integration, and the ability to expand to millions of transactions.

Cost Breakdown & Investment Insights

Transparent budgeting is important for planning and securing stakeholder buy-in:

- MVP Budget ($150K-250K): Covers core wallet set-up, including basic onboarding/OCR KYC, P2P payments, QR payments, balance UI, transaction history, simple chatbot, and referral system. This budget assumes a lean team (PM, 2-3 developers, designer, and part-time QA/Compliance Consultant).

- Full-scale platform ($300K–$600K): Includes card issuance integration, investing module development, crypto trading hooks, rewards engine, merchant SDK integration, enhanced analytics, multi-currency support, and localisation for additional markets.

- Cost variables: High-volume pilots will require expanded compliance controls, multi-jurisdiction KYC complexity, region-specific banking rails, currency conversion support, and legal/travel costs for partnerships – these ultimately inflate overall investment requirements.

- Ongoing OPEX: Include payment processing fees (interchange, ACH, or UPI per-transaction cost), cloud hosting, customer support staff, compliance audits, fraud monitoring, and platform maintenance.

- ROI Projections: Initial ROI is driven by user growth from referrals, interchange income, and subscription upsells. At a moderate growth rate, say 50K users within the next 6 to 9 months, breakeven becomes realistic within the next 9 to 12 months. Beyond breakeven, the revenues from investment fees, loans, and merchant partnerships will provide for profitability.

Attract funding, stage investment, and accelerate launch without needing validation, all while avoiding overspending before confirming traction.

Why Esferasoft? FinTech Expertise & Scaling Support

Esferasoft brings deep fintech domain knowledge and agile project delivery to your digital wallet journey:

- Proven Track Record: Successful delivery of a significant number of customised fintech platforms and digital wallet initiatives, of which a good number have already seen live deployments across regulatory jurisdictions.

- Strategic Partnerships: Strong partnerships with payment processors, issuing partners, banks, and crypto exchanges, allowing for accelerated integration and co-integration with compliance.

- Compliance & Security Leadership: Expert in PCI DSS, SOC 2, and AML/KYC frameworks to ensure the platform is audit-ready and regulator-friendly from day one.

- Agility, Sprint-Based Delivery: Iterative development with continuous integration/deployment guarantees fast time to market with high quality due to alignment in release cycles to pilot feedback and feature rollouts.

- Scaling Support Teams: Dedicated backend, operations, legal, and compliance available post-launch to support scaling into new markets, increasing transaction volumes, and expanding feature sets.

Choosing Esferasoft means choosing not just a coding partner but a partner who architects, secures, and scales the fintech infrastructure for success.

Launch & Scale Your Cash App Clone Today

The digital wallet opportunity for 2025 is huge—and the time to act is now. Start by engaging with Esferasoft experts for a free fintech readiness assessment and pilot consultation. Together, we shall evaluate your vision, check technical feasibility, and chart a 6-8 week pilot plan tailored to your target user segments.

Move quickly to secure early-bird incentives for deployments slated for Q1 2025. Let us partner with you to Build, Launch and Scale a Cash App Clone with genuine financial impact and sustainable growth. Schedule your strategy call now at +91 772-3000-038 and start on the journey of innovation!