|

Getting your Trinity Audio player ready...

|

Fintech is not merely evolving; it is rewriting the established rules of the finance industry. From cashless payments to AI-based banking, financial technology is changing the entire paradigm of interaction relevant to businesses and consumers associated with money. So what underlies all this disruption? The fintech business model itself is genuinely a force behind innovation, scalability, and profitability in this exceedingly innovative sector.

At Esferasoft, we endeavor to stay ahead of these changes and guide businesses through the complex fintech ecosystem. In this guide, we shall explain the operations of fintech firms, identify blockchain’s game-changing role in fintech, and finally reveal future developments in fintech business. So, by the end of this guide, you will have comprehensive knowledge of the fintech revolution, whether you are an entrepreneur planning to set foot in this industry or simply an enthusiast interested in the evolution of the finance trade.

Understanding the Fintech Business Model

There are many innovations that happen every other day, and therefore the industry is required to be swift and offer customer-centric solutions. The success of a particular business model that is being called “fintech” could be related to the following features:

Tech-Driven Financial Services:

The fintech companies use mechanisms such as AI, blockchain, and big data to automate and enhance financial processes with the objective of making them fast and secure in transactions.

Digital-First Approach:

Contrary to the traditional banks, the banks and institutions categorized as fintech operate mostly in an online fashion, reducing overhead expenses while simulating an all-encompassing user experience through mobile apps and platforms.

Functional Revenue Models:

Fintech startups earn subscription revenues, transaction fees, interests on the funds lent, and sometimes embedded finance solutions like Buy Now, Pay Later (BNPL) schemes.

Customer-Centric Solutions:

Offering tailored services is of utmost importance. The platforms apply data analytics to give the consumers personalized financial offerings while enhancing user engagement and retention.

Regulatory Adaptation:

Being in the field of finance, the laws regulating fintech are ever-changing, thereby requiring conformity to data privacy (GDPR, PSD2), all in the name of ensuring secure transactions.

Traditional Finance Partnerships:

Many fintech startups partner with banks and financial institutions, bridging the gap between innovation and legacy banking infrastructure.

Scalability and Market Expansion:

Fintech models are designed to promote rapid scaling, thus expanding across global markets with the help of cloud computing and API integration.

The Fintech Ecosystem: How It Works

Startups Create Innovation:

Fintech startups launch very agile and own innovations, such as offering AI lending, robo-advising, and building decentralized finance (DeFi) solutions that compete with financial institutions and challenge the status of traditional financial services.

Traditional Banks Adjusting:

Banks have now turned into partners in fintech and not just competitors, increasing digital service offerings, streamlining operations, and adopting models of open banking.

Regulators: The Rules and Frameworks:

Compliance frameworks PSD2, GDPR, and CFPB ensure protection of data, fraud prevention, and fair financial practices and, at the same time, call for transparency in their operations.

Disruption & Decentralization:

Blockchain technology disrupts payments, lending, and identity verification, eliminating reliance on third-party intermediaries and providing additional security.

Embedded Finance Everywhere:

Embedded finance refers to integrating financial services into non-financial platforms in business (for example, in-app payments, BNPL options, and instant loans), so making transactions more seamless.

AI & Big Data Powering Decisions:

In terms of smarter, faster, and safer fintech solutions—from fraud detection to hyper-personalized financial planning—AI and data analytics are driving these decisions.

Going Global with APIs:

Open banking and API-based integrations are paving the way for fintech companies to expand internationally and facilitate seamless cross-border payments, all while promoting financial inclusivity.

In essence, the fintech ecosystem is an open battlefield involving innovation, regulation, and user demand shaping the future of finance. Organizations that can adapt quickly will be at the forefront of this new wave of financial transformation.

Blockchain in Fintech: Transforming Financial Services

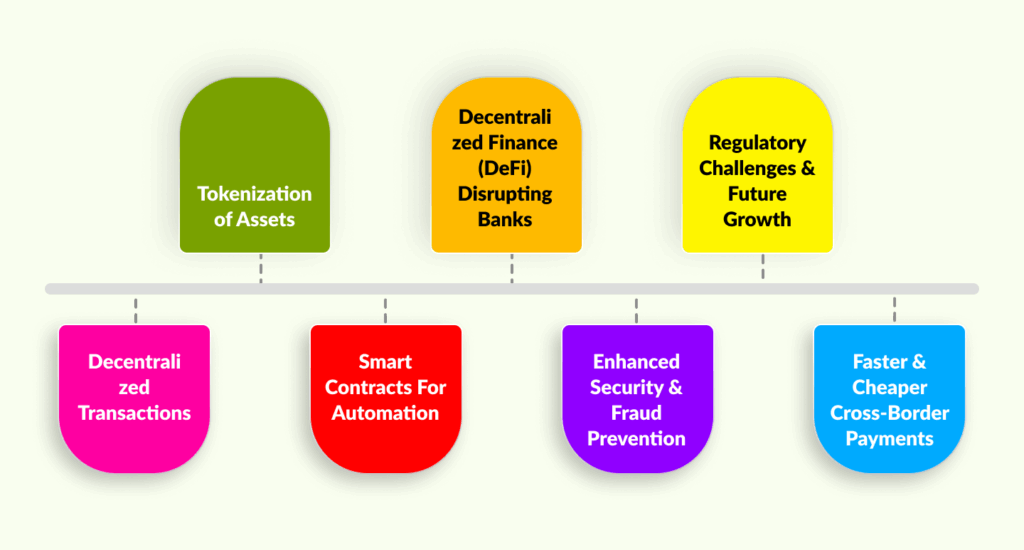

Decentralized Transactions:

Say goodbye to middlemen! Blockchain removes banks and third parties, enabling direct, peer-to-peer transactions with lower fees and faster processing.

Smart Contracts for Automation:

Self-executing contracts eliminate paperwork and manual approvals, reducing fraud and ensuring secure, automated financial agreements.

Enhanced Security & Fraud Prevention:

With its immutable ledger, blockchain prevents data tampering, making it nearly impossible for hackers to alter financial records.

Faster & Cheaper Cross-Border Payments:

Traditional bank transfers can take days. Blockchain-powered transactions settle in minutes, reducing costs and delays for global payments.

Tokenization of Assets:

Real estate, stocks, and even artwork can be digitized into tokens on a blockchain, making asset trading more accessible and liquid.

Decentralized Finance (DeFi) Disrupting Banks:

DeFi platforms offer lending, borrowing, and yield farming without the need for banks, opening financial opportunities to the unbanked.

Regulatory Challenges & Future Growth:

Governments worldwide are working to regulate blockchain in fintech, balancing innovation with compliance for secure financial ecosystems.

Future of Fintech Business: Trends and Opportunities

Fintech continues to advance and accelerate into uncharted domains. These are a few of the scenarios that lie ahead amid the broad spectrum of future possibilities for the industry:

AI-Powered Finance:

Banking becomes smarter and safer with artificial intelligence-fueled strategies that will take over fraud detection, credit scoring, and hyper-personalized self-service financial operations.

Embedded Finance Everywhere:

Picture ordering a lift and instantly getting a loan or buying groceries with an interest-free payment option—these financial services will seamlessly integrate into everyday applications.

The Rise of Central Bank Digital Currencies (CBDCs):

Digital currencies introduce modernized payment transactions with reduced transaction costs, and cryptocurrencies emerge as new competitors in the competitive landscape.

DeFi & Web3 Revolution:

Traditional banking will continuously be disrupted by DeFi. Here, one can do peer-to-peer lending, staking, and investing without intermediaries. Hyper-Personalized—using big data and AI to analyze spending habits to deliver custom-tailored financial products so that whatever a person sees to use will only be what’s relevant to him/her.

Sustainable and Green Fintech:

Advances in ESG (Environmental, Social, Governance) investment are set to propel fintech into green banking, ethical investment, and sustainable financial solutions that are carbon neutral.

Regulations are catching up:

As the fintech industry is booming, global regulators are implementing stricter policies related to data protection, cybersecurity, and financial inclusion to drive further and better industry development.

Metaverse and Fintech Convergence:

Virtual banks, NFT-based assets, and crypto payments will take shape as part of the new normal within metaverse economies, defining and opening new future frontiers in finance.

Fintech’s Future: Innovate, Adapt, or Get Left Behind

From powered banking to decentralized finance, the industry is making innovative and agile strides. EsferaSoft continues to help businesses navigate these dynamic changes. The fintech business model will undoubtedly continue to thrive.

Fintech will become fundamental for entrepreneurs, investors, and financial institutions, requiring them to keep up with change, adopt advanced technologies, and comply with emerging regulations. Opportunities abound, from the blockchain transformation of traditional banking to embedded finance changing the nature of everyday transactions.

Those who dare to innovate will conquer the emerging fintech space. So, are you ready for this revolution? If yes, then call us right away!