|

Getting your Trinity Audio player ready...

|

Rise of Hyperlocal Delivery in the GCC

Hypothetically, he is not required to be considered the latest. Hyperlocal delivery over the past five years has seen a gradual evolution from a small-time provision to an essential component of realising the full benefits of a digital economy among the Gulf Cooperation Council’s (GCC) states. This thriving sector promises much in terms of its potential in 2025, mainly due to rapid urbanisation, mobile-first consumer behaviour, and a considerable swelling in demand for near-real-time, at-home services.

From groceries to prescription medications, users have grown to expect on-demand access to products within minutes, not hours. Hyperlocal Last-mile delivery UAE/KSA platforms are fulfilling this demand by offering micro-logistics solutions that are precise, fast, and location-aware.

Differences Between UAE & Saudi Arabia Markets

Both the UAE and the Kingdom of Saudi Arabia have been working towards digitalisation; however, a few factors like market maturity, varying infrastructure, and regulatory climate make them quite different from one another.

- There are smart cities in Dubai and Abu Dhabi, in which the whole tech ecosystem is proliferated in the UAE with its diverse multicultural user base.

- Saudi Arabia is witnessing an insane spike in digital growth as part of Vision 2030, which will see huge investments into logistics, infrastructure, and e-governance.

Why is Hyperlocal Software Highly Demanded in 2025?

The convergence of e-commerce, Q-commerce, and instant delivery models drives companies to invest in hyperlocal solutions.

- Consumer Expectations: Deliveries in under 60 minutes are a new norm.

- Business Advantage: Hyperlocal logistics will lower delivery expenditures through fleet optimisation and local inventory.

- Regulatory Push: Both countries are introducing new digital compliance mandates to support a universally traceable, tech-enabled delivery ecosystem.

What is Hyperlocal Delivery Software?

Core Concept and Functionality

A hyperlocal delivery software UAE solution is a computerised platform used for the real-time delivery of goods or services to a specific geographic radius—usually 2 to 10 km from the point of sale.

This system can comprise:

- Customer-based platforms facilitate the placement and tracking of orders.

- The Vendor dashboard manages inventory and dispatch.

- Delivery agents can use the app to carry out orders and optimise their routes.

- The administrative panels act as a backbone for maintaining and analysing the entire system.

Some of the major use cases:

- Food delivery: Right from restaurants and cloud kitchens, paying a premium for quick, location-specific routing of orders

- Grocery delivery: Get fresh items straight from neighbourhood supermarkets.

- Pharmacy orders: Timely deliveries of medicines with uploaded prescriptions.

Home Services: On-demand plumbing, repair, and cleaning services are available.

How It Differs from Traditional Delivery Platforms

These platforms are built for scheduled deliveries across longer distances, and hence, fulfilment cycles span over several days. This is different from hyperlocal Last-mile delivery UAE/KSA, which varies in a few key areas.

- Delivery Timeframes: Minutes versus days.

- Logistics Mapping: Dense, local mapping instead of wide-area routing.

- Inventory Management: Local stock vs. Centralised warehouses.

- Customer Relationships: Real-time communication, chat, and updates.

Why GCC is a Hotbed for Hyperlocal Delivery

UAE Market Highlights

- Smart City Infrastructure: The 5G backbone of Dubai imparts smart traffic systems and AI-enabled public services, enabling seamless logistics operations.

- Digital Payments Boom: The rampant acceptance of digital payment methods such as Apple Pay, Samsung Pay, and PayTabs has curtailed cash management.

- Diverse Demographics: The expat-laden population creates demands for multi-language options and varying delivery categories.

- High Mobile Penetration: With over 99% smartphone penetration, the app economy is alive and thriving.

Saudi Arabia Market Highlights

- Vision 2030 Impact: The Kingdom’s national strategy on e-commerce expansion, SME growth, and innovation hubs like NEOM directly benefits the digital delivery economy.

- Geographic Challenges: Unlike the UAE, Saudi cities have a large area with dispersion, requiring advanced geo-fencing and dispatch algorithms.

- E-invoicing & Tax Compliance: The Fatoora system mandates the issuance of digital receipts and is fully integrated into the delivery platform.

Cultural Considerations: Arabic-first experiences are indispensable. This applies to UI/UX, customer care, and communication with vendors.

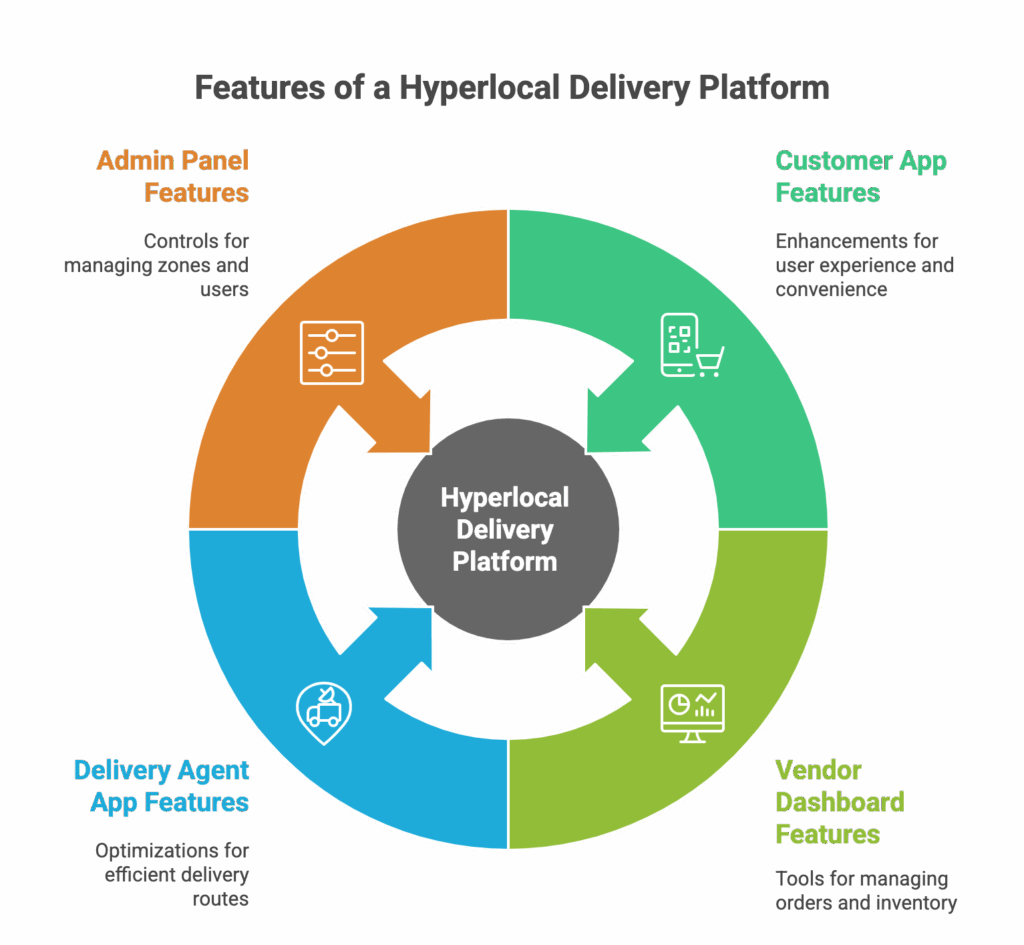

Key Features in a Hyperlocal Delivery Platform

Customer App Features

This platform provides live order tracking with dynamic maps, driver name, estimated time of arrival (ETA), and vehicle tracking functions.

- Multi-Category Ordering: users are allowed to add multiple items from different stores under one single checkout.

- Localised Offers: City-based discounts, seasonal sales (Ramadan, Eid), and loyalty rewards.

- One-Tap Reorders: Quick repeats of frequently ordered meals or groceries.

- Digital Wallets: Functions for recharge, refund, and cashback.

Vendor Dashboard Features

- Order Management System: Accepting, rejecting, or scheduling orders based on real-time stock.

- Inventory Integration: Synchronisation with POS or ERP for dynamic product listings.

- Delivery Assignment: Manually assigning deliveries or auto-dispatching to in-network drivers.

- Sales Reports: Daily sales breakdowns, category trends, and consumer retention metrics.

Delivery Agent App Features

- Route Optimisation: AI-enabled routing is designed to ensure the fastest delivery by considering traffic conditions and the delivery stack.

- Task Scheduling: Accept multiple deliveries along a defined route.

- Live Updates: Keeping the customer informed in real time.

- Earnings Dashboard: Daily and weekly payment reports along with shift bonus and tipping history.

Admin Panel Features

- Zone Mapping: Define precise delivery radii for each vendor.

- Service Radius Config: Dynamically adjust serviceable areas based on traffic, weather or demand.

- User Management: Activate/suspend accounts, manage reviews.

- Real-Time Analytics: Order per region, average delivery time, and satisfaction scores.

Technology Stack Used in Development

To ensure scalability, security, and performance, use the following stack:

| Component | Preferred Technologies |

| Backend | Node.js (scalable), Django (secure), Laravel (fast MVPs) |

| Frontend | Flutter (cross-platform), React Native (native feel), Angular (admin panels) |

| Maps & Geo-location | Google Maps API (UAE), Mapbox, HERE (KSA-specific routing) |

| Notifications | Firebase (push), Twilio (SMS), OneSignal |

| Payment Integrations | Stripe, HyperPay, PayTabs, Apple Pay, STC Pay, Mada |

You may also need tools for AI routing, chat support, and cloud hosting (AWS, Azure, or local options like G42 in the UAE).

UAE: Innovation at the Intersection of Governance and Technology

1. A Digital Government Strategy for 2025

The UAE’s Digital Government Strategy 2025 aims to revolutionise governance by completely digitising user-centered services. The framework of this model rests on eight fundamental pillars: inclusive by default; resilient; fit for the digital age; user-driven; digital by design; data-driven; open by default; and proactive.

The aforementioned measures have led to the complete digitalisation of over 90 percent of government services. Central platforms such as UAE Pass, TAMM, and DubaiNow provide seamless access to public service offerings anywhere in the country. The strategy is more real-time interaction, integrated artificial intelligence, and access to public utilities via a mobile-first platform. All other initiatives, including regulatory sandboxes, unified service buses, or real-time tracking of citizen satisfaction, were introduced.

2. Investment in AI, Data, and Infrastructure

Significantly spearheading the UAE’s AI agenda is the Ministry of State for Artificial Intelligence, Digital Economy and Remote Work, with high-profile initiatives among them:

- The AI Ethics Charter, which was released in 2024, sets the principles for responsible use of AI.

- Abu Dhabi has significantly invested in its AI data centre cluster; therefore, it has one of the largest.

- The national AI-native government strategy, 2025 to 2027, is supported by a 13 billion AED fund focusing on automating federal processes, sovereign cloud platforms, and decisions made by AI across ministries.

AI systems are in operation, issuing work permits to speed up the legislative process by simplifying the drafting of laws.

3. Cost and Compliance of Custom Software Development

In the UAE, software development varies between AED 50,000 and AED 300,000, depending on the type of project, its scale, and its complexity.

- Basic MVPs: from AED 50,000 to 100,000

- Mid-level enterprise applications: AED 100,000 to 200,000

- AI, fintech, or government-grade platforms: from AED 200,000 onwards

The regulatory factors involve mandatory data localisation for sensitive sectors, such as healthcare and finance, integration with UAE Pass for authentication, and hosting inside Etisalat or government-accredited data centers.

Saudi Arabia: Digital Sovereignty and Visionary Investment

1. Vision 2030 and Digital Government Evolvement

The National Transformation Program aims to evolve Saudi Arabia’s economy from being oil-dependent to becoming a modern economy in line with Vision 2030. The Digital Revolution is one of the key pillars for the successful implementation of the Vision 2030, supported by the National Transformation Program and several government entities.

Key Components Are As Follows:

- The National Transformation Program builds smart cities such as NEOM.

- Absher is a platform facilitating the expansion of digital public services by providing access to more than 2,500 services.

- Watani’s real-time feedback system evaluates citizens’ contentment with public services.

- Open data initiatives are being implemented through national portals, and there is a huge trend toward cloud-first government systems.

2. Growth of AI and Technology Fuelled by PIF

It has turned out to be the backbone of Saudi Arabia’s technological leap. PIF launched Humain, an AI company, in 2025, which primarily focuses on constructing large language models (LLMs) in the Arabic language.

- Humain primarily focuses on the construction of large language models (LLMs) in the Arabic language.

- A sovereign data infrastructure is also one of their priorities.

- The company provides AI applications for various industries such as government, logistics, and education.

Saudi Arabia houses more than 2,200 megawatts of data center capacity, capitalising on its drive to become one of the most ambitious players in global AI infrastructure development. The National Strategy for Data and AI aims to position the country as one of the world’s top 15 AI leaders by 2030.

3. Development Cost of Software and Local Perspective

Software development in Saudi Arabia ranges between SAR 45,000 and SAR 250,000:

- Simple apps and portals- SAR 45,000 to 80,000

- Logistics and ERP platforms- SAR 100,000 to 200,000

- AI-enabled or Arabic-English bilingual platforms- SAR 200,000 and above.

Arabic-first interfaces are typically prerequisites for most of these solutions, especially in government and regulatory environments, as well as compliance with data localisation regulations and solutions hosted locally.

Hyperlocal vs Quick Commerce: Understanding the GCC Delivery Models

While hyperlocal delivery and quick commerce (Q-commerce) are similar in their emphasis on swiftness and proximity, the two models differ in structure, inventory, and operational strategy, with special reference to the Gulf Cooperation Council (GCC).

Hyperlocal delivery aims to connect users with local vendors (such as restaurants, pharmacies, or corner stores) to fulfil orders. It has a decentralised model, whereby each vendor owns its own inventory. Orders are usually completed within a radius of 2–10 km through some form of marketplace logic and are best suited for cities that have high population densities, like Dubai, Abu Dhabi, Riyadh, and Jeddah.

QuickCommerce, on the other hand, is an entirely centralised system. This uses dark stores, microwarehouses, and company-owned fleets to ensure delivery in less than 15–30 minutes. Start-ups such as Talabat, Noon Minutes, and Nana Express are looking into Q-commerce in Dubai and Riyadh.

Key Differences:

| Feature | Hyperlocal Delivery | Quick Commerce |

| Inventory Source | Local vendors | Company-owned or dark stores |

| Fulfillment Radius | 2–10 km | 1–3 km |

| Fleet Ownership | Aggregated or freelance | In-house |

| Use Cases | Multi-category (food, grocery) | Mostly FMCG & essentials |

| Operational Cost | Lower CAPEX | High CAPEX (dark stores, fleet) |

Conclusion: Hyperlocal is ideal for startup experimentation and service diversity, while Q-commerce requires significant investment but enables tighter control and lightning-fast delivery—making it suitable for well-funded GCC ventures with regional scalability in mind.

Scaling Challenges: How to Grow a Delivery Platform Without Losing Speed

Scaling a hyperlocal delivery platform in the GCC is much more than getting onboard new vendors or adding new geographic coverage. How do you grow while maintaining platform stability, delivery accuracy, and real-time sync, especially during such peak times as Ramadan, weekends, or national holidays?

Key Scaling Pain Areas:

- Logistics Matching Latency: With increased vendors, riders, and orders, ensuring instant allocation is becoming computationally heavier.

- API Issue: Performance issues can arise during the integration of local systems (such as POS, maps, e-wallets, etc.) if the process is not done optimally.

- Driver Supply Imbalance: Rapid geographic expansion leads to a shortage of trained last-mile agents, especially in low-density or Tier 2 cities.

- Overload of Live Tracking: Overloaded backend services from real-time updates on many hundreds of concurrent deliveries unless backed by a proper architectural design.

Best Practices for Scalable Growth:

- Microservices architecture should be implemented for modular scaling.

- An AI-based auto-dispatch should help with driver allocation in dense urban zones.

- Elastic cloud infrastructure (e.g., AWS Auto Scaling, G42) should be in place to absorb traffic spikes.

- Sustaining operational reliability with load balancing and real-time error tracking.

Decoding Consumer Behavior in GCC’s Instant Delivery Economy

Mobile-first culture, Donald, parallel lines of digital literacy and convenience-inspired lifestyles draw consumer expectations. Consumer expectations hover just above those of the UAE and Saudi Arabia. To build any design platform, plan a campaign, or prioritise features, one must understand such behaviours towards consumer expectations.

Key Trends on the GCC App Usage in Deliveries:

- Instant Gratification: Delivery windows within 60-90 minutes become increasingly tagged as slow. Apps that promise delivery in fewer than 30 minutes pulverise apps without such gratification tags.

- Culture’s Timing: App usage involves bursts in Saudi Arabia after sunset, during Ramadan, while in the UAE, it peaks most of the time after office hours (from 6 to 9 pm) generally.

- Multi-language Interface: Platforms that offer interfaces in Arabic, English, and Hindi/Urdu are likely to experience retention advantages due to the large expatriate populations in the UAE and the diverse user bases in KSA.

- Social Proof & Ratings: Buying decisions frequently rely on the customers’ local reviews and delivery ETA rating evaluations before they can decide whether to place an order.

Implications for Design & Marketing:

- Using localised, personalised offers with place and time, as well as order history, puts the target consumer at the forefront of every transaction. The user interface boldly displays express-delivery filters and real-time ETAs.

- Implement the first Arabic chatbot and multi-language customer support tools.

Voice Search, Chatbots, and the Future of Ordering on Delivery Apps

Conversational commerce will dominate the next wave of GCC digital delivery. While voice search and chatbots are being adopted by tech-savvy users in a highly penetrated smartphone market, they are transitioning from desired features to customer expectations.

Voice Search in Hyperlocal Applications:

- This feature is perfect for individuals who are multitasking or placing orders while on the move.

- The system must support natural language processing in various languages, including different Arabic dialects and transliterated phrases like ‘order mandi from Arif.

- This feature improves accessibility for elderly individuals or those less familiar with UI navigation.

AI Chatbots for Order Management:

- Can repeat tasks: order status enquiries, address updates, and promo codes.

- The chatbots are also integrated with vendor-side dashboards to facilitate livestock confirmations.

- It can reduce customer service by around 30–50% in high-traffic periods.

Emerging Use Cases:

- Voice reordering: “Repeat my last grocery order.”

- Contextual upselling: “Would you like tissues with your cold medicine?”

- In-app smart assistants give timely reminders, depending on the weather and the user’s behavioural history.

Future Outlook: By 2025 and beyond, these platforms, which combine natural language processing (NLP)-based smart recommendations with a real-time conversational UI, will rule the GCC delivery ecosystem as user expectations increase.

UAE vs Saudi Arabia: 2025 Snapshot Comparison

| Metric | UAE | Saudi Arabia |

| National Strategy | Digital Government Strategy 2025 | Vision 2030, National Transformation Program, NSDAI |

| E-Government Maturity | Over 90% digitized services | Over 2,500 digital services; rapidly expanding |

| AI and Cloud Infrastructure | AI-driven governance; Abu Dhabi data cluster | PIF-backed Humain: 2,200 MW+ of AI infrastructure |

| Key Digital Leaders | Ministry of AI, Smart Dubai, TRA | PIF, SDAIA, MCIT, KACST |

| Software Development Cost | AED 50,000–300,000 (approx. USD 14,000–82,000) | SAR 45,000–250,000 (approx. USD 12,000–67,000) |

| Market Strengths | Regulatory agility, smart cities, English-first UX | Data sovereignty, scale, Arabic-first digital frameworks |

Hyperlocal Delivery: Digital Infrastructure Meets Real-Time Demand

The UAE boasts tremendous integrated urban planning and digital ecosystem services, making it an ideal location for hyperlocal delivery platform tests. The added benefit for companies include

- The availability of public APIs from government services such as DubaiNow and RTA is another advantage for companies.

- UAE Pass enables integrated identity verification.

- Smart IoT infrastructure deployed across the city enhances location tracking and optimises logistics.

While some popular use cases are

- Delivery services for groceries and restaurants are among the popular use cases.

- The collection of medicine and laboratory samples is a popular use case.

- Concierge services and last-mile courier platforms.

Saudi Arabia: Scale And Arabic-First Opportunities

Saudi Arabia’s growing cities and high cell uptake provide huge and untapped markets for hyperlocal delivery. Vision 2030 puts several key pieces of infrastructure in place to underpin economic growth.

- One example of such infrastructure is a nationwide digital addressing system.

- New urban developments like NEOM are embedding smart mobility and logistics infrastructure.

- The government provides backing for apps that prioritise Arabic content and digital ecosystems that cater to small and medium-sized enterprises.

Hyperlocal platforms that are able to localise content will do well if they integrate with the government’s APIs.

From Pilot to Rollout: Launching Your Hyperlocal App in the GCC

Launching a hyperlocal delivery app in the GCC is not just about launching; it is also about validating, customising, and scaling in perhaps the toughest and most varied set of regulatory frameworks. Your launch strategy must be structured, flexible, and compliant, whether within the UAE’s densely urbanised zones or across Saudi Arabia’s large but dispersed geography.

1. Hands-on Pilot Testing

You should conduct MVP testing in a small area—a neighbourhood in one city or a single category (i.e., food only at Dubai Marina or groceries only at Riyadh North). A suitable pilot area will:

- Have high smartphone penetration with a plethora of on-demand service seekers.

- Provide high vendor visibility, with foot traffic from locals.

- Confirm availability of riders or integration with fleet partners.

2. Feature Localization for Immediate Validation

- Your app should include, at a minimum, foreign interfaces (Arabic + English) during the pilot stage.

- You should incorporate local payment gateways such as STC Pay in the Kingdom of Saudi Arabia or PayTabs in the United Arab Emirates.

- Customise the service radius based on density and traffic data.

3. Analyze and Adapt

Run A/B tests on pricing, delivery times, UI flows, and customer acquisition channels. Leverage analytics to:

- Identify cart abandonment points.

- Measure vendor fulfilment rates.

- Track delivery agent performance and customer feedback.

4. Phased Rollout Plan

Post-pilot, use a phased expansion model based on refined operations and tech:

- Add contiguous service zones within the same city.

- Expand into the second category (for example: pharmacy after grocery).

- Go to a second city with locally tailored solutions for the market.

5. Get Prepared for Licensing and Regulatory Work

- Get documentation prepared at an early time for:

- Obtain approval for the CITC digital platform in Saudi Arabia.

- The UAE requires TRA compliance and VAT registration.

- Cloud hosts must adhere to data residency policies.

Launching in the GCC involves a unique blend of targeted testing, local intelligence, and phased optimisations. The better you structure your pilot, the better you’ll be able to capitalise on your rollout.

Fleet Tech in the GCC: Telematics, AI Cameras, and Driver KPIs

Fleet tech is set to become the core differentiator in the hyperlocal delivery operations of GCC countries. Smart routing coupled with real-time safeguarding will enable tech-enhanced fleets to operate more efficiently, cut costs, and provide better customer experiences, whether in congested urban or sprawling suburban spaces.

1. Telematics for Real-Time Fleet Visibility

Telematics systems can provide data about vehicle movements, engine condition, driver behaviour, and so forth, with systems for hyperlocal delivery fleets in the GCC implementing real-time fleet visibility:

- Geo-fencing ensures drivers remain within designated areas.

- Real-time alerts are sent when route deviations or delays exceed acceptable limits.

- Monitoring mileage provides a basis for predictive maintenance, especially in high-temperature Gulf environments.

2. AI Cameras and Safety Systems

Installation of AI dash cameras in delivery vehicles or on motorbikes adds an additional layer of operational intelligence:

- It detects distraction and risky driving behaviours (e.g., phone use, harsh braking).

- It helps in clarifying liability disputes in cases of traffic incidents.

- It encourages compliance with road traffic safety legislation, especially in high-risk areas.

3. Driver KPIs: Beyond Delivery Time

All prior metrics, such as Average Delivery Time are now too static to determine driver success. Operators in the Gulf Cooperation Council (GCC) are currently monitoring the following metrics:

- Acceptance rate (orders accepted vs. offered)

- First Attempt Success Rate (delivery completed without re-routing).

- Customer rating trends are monitored over time.

- Heatmap-based efficiency, whereby drivers are evaluated according to performance in various zones.

4. Integrated Systems Linking Dispatch and Analytics

Modern fleet systems would thus seamlessly integrate with either the admin panel or the dispatch console to:

- Auto-assign jobs based on driver proximity and availability.

- Create shift-wise performance reports.

- Track SLA observance (i.e., 90% of orders delivered in under 30 minutes).

5. Regional Considerations

- KSA: Heat tracking and engine diagnostics are paramount for successful operations in cities like Riyadh, where regional temperature exceeds 45°C.

- UAE: Routing in densely populated areas in Dubai would entail integration with smart traffic systems (Roads Transport Authority APIs) for re-routing effectively during congestion.

Fleet tech is not just tracking; it is a competitive advantage in efficiency, safety, and reliability. As the GCC delivery ecosystems transition to data-driven environments, operators who invest in intelligent fleet solutions will emerge as the victors.

Cost Breakdown – UAE vs Saudi Arabia

Development Cost in UAE

- MVP Build: AED 75,000–110,000

- Full-featured Platform: AED 150,000–220,000

- Drivers of Cost:

- Complex UI/UX for multi-language support

- Integration with local APIs and logistics partners

- Hosting on UAE-based cloud for data residency

- Complex UI/UX for multi-language support

Development Cost in Saudi Arabia

- MVP Build: SAR 85,000–130,000

- Full-featured Platform: SAR 180,000–250,000

- Additional Cost Factors:

- Arabic-first interface and RTL development

- Fatoora e-invoicing integration

- Compliance testing and CITC approval

- Arabic-first interface and RTL development

MVP vs Full-Scale Platform Comparison

| Feature | MVP (UAE) | MVP (KSA) | Full App (UAE) | Full App (KSA) |

| Core Features | AED 75K | SAR 85K | AED 180K | SAR 220K |

| Timeline | 2–3 months | 2–3 months | 4–6 months | 4–6 months |

| Payment Gateways | PayTabs | HyperPay | Stripe, Apple Pay | STC Pay, Mada |

| Language Support | EN/AR/Hindi | AR-only | Multilingual UX | RTL & Arabic only |

Region-Specific Considerations

Language and Localisation

- UAE: The applications should support English, Arabic, and Hindi or Urdu with toggles for region-specific content.

- Saudi Arabia: Full Arabic support with RTL formatting is a must for all modules.

Regulatory Compliance

- UAE: TRA regulations are present; VAT should be integrated (5%) and there are certain laws for data privacy.

- Saudi Arabia: CITC digital platform licensing compliance, compliance with e-invoicing in the Fatoora model, and compliance with payment regulations for Mada are required.

Payment Integration Preferences

| Region | Popular Gateways |

| UAE | Network Intl, PayTabs, Apple Pay, Google Pay |

| KSA | HyperPay, STC Pay, Mada, Tahweel Al Rajhi |

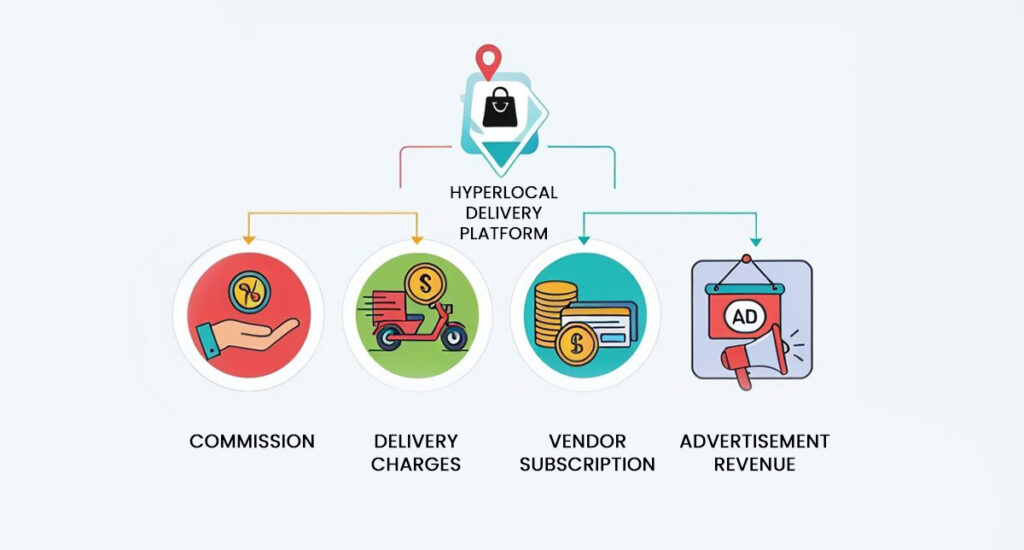

Monetisation Models for Hyperlocal Platforms

- Commission – Commission on sales from vendors.

- Delivery Charges – Delivery fees and surge pricing during peak hours.

- Vendor Subscriptions – Advanced dashboard tools, promotions, and listing priority will be charged on a monthly and quarterly basis.

- Advertisement Revenue – Sponsored listings banner ads, and product highlights.

- Freemium Tiers – Grant access for free at the basic level, then charge a subscription for premium analytics and features

Choosing Between UAE & Saudi Arabia – Business Perspective

| Parameter | UAE | Saudi Arabia |

| Market Size | Moderate, urban-focused | Large, nationwide growth |

| Infrastructure | Fully mature | Growing rapidly |

| Ease of Entry | Moderate | Complex regulatory pathway |

| Localization Need | Medium (expat support needed) | High (Arabic-first essential) |

| Tech Talent | Strong startup ecosystem | Limited but improving |

| Government Support | High for smart tech | High via Vision 2030 |

Common Development Challenges

- Real-time Logistics Syncing: Synchronisation of users, vendors, and agents in real time, with multiple users.

- Arabic RTL UI Bugs: RTL layout problems could cause an application to crash when not properly tested.

- Geo-Fencing and Custom Zones: Custom zones must be defined by businesses’ complex delivery zones that show differences upon traffic and weather changes.

- Volume Handling: Load testing is critical because traffic spikes are due to surplus users during festivals (Eid, Ramadan).

Tips for Hiring the Right Development Partner in GCC

Select a team with GCC logistics expertise.

- Cross-check availability of multilingual project delivery (Arabic + English + Hindi).

- Request case studies for implementation platforms, preferably launched in UAE/KSA.

- Confirm a 24/7 support structure for post-launch operations and SLA guarantees.

- Verify familiarity with regulatory compliance: TRA, CITC, Fatoora, and VAT.

How Esferasoft Systems Can Help You Build Hyperlocal Delivery Software

As a company focused on Dobato and serving the GCC market, Esferasoft Systems provides effective solutions.

- Entire Development: Ideation to design for development-stage launch and growth.

- Specialisation of the GCC: Formation of experience in areas related to Fatoora, VAT, and Mada; additional regulatory protocols involved in these areas.

- Business-Fit Price Models: Flexible packages for both startup ideas and corporates; very easy to come to win this deal.

- Rapid Turnaround: Backing an MVP is done in less than 8 weeks.

Get a free consultation and personal quote tailored to your budget needs and business model.

Delivering Success Across UAE & KSA

Hyperlocal delivery software in the UAE and Saudi Arabia has a promising future, yet each market presents unique challenges and opportunities. The proposition operates at two speeds: the UAE has diverse user bases with varying infrastructure returns, while Saudi Arabia offers scale and national digital momentum.

For instance, when looking at the costs, compliance, features, and localisation needs of different on-demand delivery software, choose the one that best matches your business goals and is aligned with the readiness of your region. No matter the market, however, that alone is the key investment for the industry to stay competitive toward 2025: a strong, localised, and scalable delivery platform.

Are you prepared to elevate your platforms to a higher level? Consider selecting the appropriate GCC delivery app development partner to begin creating a platform that truly delivers. Contact us today at +91 772-3000-038 for further enquiries!

Frequently Asked Questions (FAQs)

1. What will it cost to build hyperlocal delivery software in the UAE?

Hyperlocal delivery software UAE costs anywhere between AED 75,000 and AED 220,000, depending upon features, tech stacks, and localisation.

2. How much does it cost to develop hyperlocal apps in Saudi Arabia?

Costs in Saudi Arabia range from SAR 85,000 to 250,000, with Arabic UX and other regulatory compliance affecting pricing.

3. Is hyperlocal software costlier in KSA than in the UAE?

Yes, just slightly. KSA apps usually require an Arabic-first design, support for right-to-left (RTL) text, and compliance with e-invoicing regulations, all of which increase on-demand delivery software costs.

4. What are the major features of a hyperlocal delivery app?

A Hyperlocal delivery app Saudi Arabia features real-time tracking, multi-category ordering, vendor and driver dashboards, route optimisation, and in-app payments.

5. What is the time required for a hyperlocal delivery platform development?

Typical timelines are going to be between 2 and 3 months for MVPs and between 4 and 6 months for a full-fledged setup.

6. Which tech stack do you apply for hyperlocal delivery software?

Popular choices include:

- Backend: Node.js, Django

- Frontend: Flutter, React Native

- Maps: Google Maps, Mapbox

- Payments: Stripe, PayTabs, HyperPay

7. Do I require a separate app for vendors and delivery partners?

Yes. Vendors require an order management system, while delivery agents require features to manage navigation and track the task.

8. What are the best payment gateways for the UAE and Saudi markets?

- UAE: PayTabs, Apple Pay, Network International

- KSA: STC Pay, HyperPay, Mada

9. Can I create an app in two languages—Arabic and English—for the GCC?

Definitely. Bilingual apps are better, as they appeal to locals and expats, especially in the UAE and KSA.

10. What’s the difference between hyperlocal and traditional delivery apps?

Hyperlocal apps are designed for instant deliveries within a small radius, whereas more general apps cover longer-distance deliveries or scheduled deliveries.

11. Should I outsource GCC delivery app development to a local company or to a remote one?

If you maintain local compliance and ongoing support, outsourcing to a remote team with GCC experience can still be cost-effective.

12. How do I make sure that my delivery software meets KSA or UAE regulations?

Consult the following developers:

- UAE: TRA, VAT

- KSA: CITC, Fatoora, Mada

This secures smooth approvals and legal operation.