|

Getting your Trinity Audio player ready...

|

Money went from coins to paper, from plastic to pixels; now it lives in our pockets completely formless. Mobile wallet apps have revolutionized the ways people spend, send, and save—all without sacrificing anything in security, speed, or convenience. But behind every seemingly frictionless transaction lies a complex scaffold of encryption, compliance, and user experience design. Building a mobile wallet application isn’t just about enabling payments; it’s also about creating an environment of trust, assuring that everything will be safe, and delivering an unimpeded financial experience. EsferaSoft has everything—the know-how, resources, and technology-facilitated office space to innovate a mobile wallet app development that doesn’t just meet industry standards but also enhances how users interact with their finances. The guide will walk you through the prominent steps, challenges, and innovations in developing a mobile wallet application. They’re ready to take one step further into creating their solution in today’s digital economy.

Success Factors for Mobile Wallet Application

The ideal mobile wallet application should focus on security, usability, and seamless transactions, among other things. Six key features define a successful mobile wallet:

Multi-Layered Security:

User data and transactions exist in a somewhat private intranet space protected from fraud by strong encryptions, biometric authentication-fingerprint, face ID-and dual two-factor authentication (2FA).

Seamless Payment Integration:

Users should be able to find all payment modes or options, like credit/debit card options, bank transfers, UPI facilities, and QR codes, creating a smooth transaction experience.

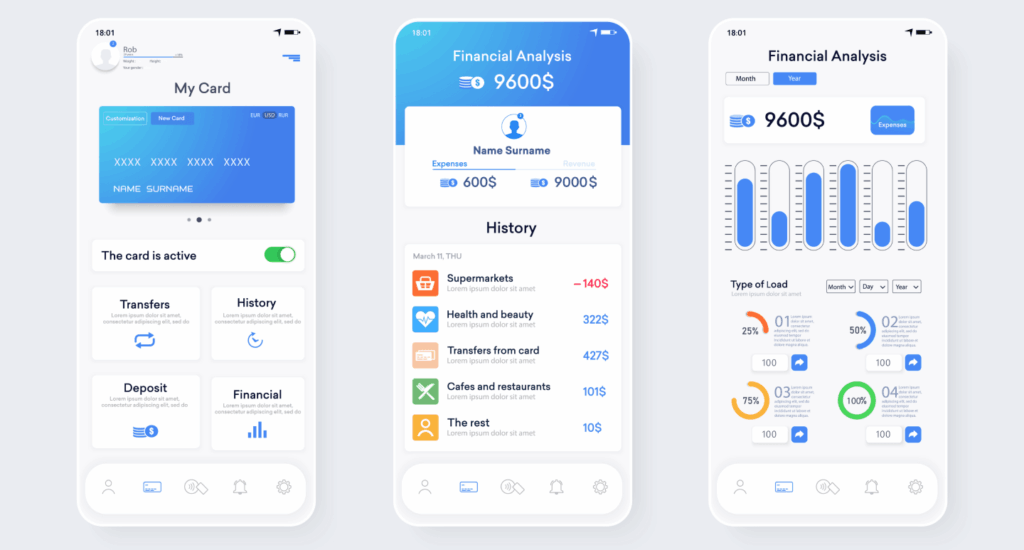

User-Friendly Interface:

Simple and intuitive designs allow users to access important app and transaction-associated features easily without hassle.

Instant Money Transfer:

With peer-to-peer transfers going direct into the bank, transferring money has become fluid and effortless.

Transaction History & Expense Tracking:

Users should have access to logging transactions and classifying expense tracking in the app.

Loyalty Rewards & Cashback:

Incentives such as cashback, discounts, and reward programs motivate users to participate in and use the app.

If you build your mobile wallet app focusing on these six feature areas, the app will definitely satisfy consumer expectations while also helping to build that competitive edge in the digital payments market.

How to Promote Security in Mobile Wallet App Development

Security becomes the backbone for any mobile wallet app. It stores sensitive financial data and needs the architecture to be built like a fortress. Here are the primary points of security that should be considered while going through mobile wallet app development:

End-to-End Encryption:

Encrypt complete data transmission and data storage using AES-256 and SSL/TLS protocols to avoid cyber threats for users.

Multi-Factor Authentication (MFA):

Fingerprints, face identification, OTP bases, or other modes, and not just passwords, should be employed in multi-authentication schemes.

Use of Tokenization to Secure Transactions:

The confidential details of a card are substituted with a randomly generated token to prevent fraudulent acts and unauthorized access.

Integrated Secure Payment Gateway:

PCI DSS includes those payment gateways that have been devoted to safekeeping and encrypting financial transactions within them.

Real-time Fraud Detection:

Implement AI-powered fraud detection systems to facilitate delinquent activity monitoring and unauthorized transfer prevention.

Regular Security Audits and Penetration Testing:

To identify vulnerabilities and address them before hackers exploit them, regular security assessments are necessary.

KYC & AML Compliance:

It includes implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) provisions to safeguard against any fraudulent identities and financial crimes.

Session Timeout & Auto Logout Feature:

Logout the user automatically after inactivity to prevent unauthorized access in case the user loses or has his device stolen.

A Step-By-Step Guide to Building a Mobile Wallet App

A Step-By-Step Guide to Building a Mobile Wallet App

eWallet app development is beyond the usual code; it is an exercise in securing a seamless application for financial use. The way to design and develop your digital wallet would be:

Envisioning and Setting the Core Features:

Does your app focus on peer-to-peer payments, QR codes, or even integrating cryptocurrencies? Identify features that the wallet simply cannot do without if it’s going to be distinctive.

Select the Suitable Tech Stack:

Pick those that are securely performant, for instance, Swift/Kotlin for native apps versus React Native for cross-platform take. Furthermore, consider a full-fledged backend with cloud integration.

Ensure Compliance:

Digital wallets handle sensitive financial data. Thus, for legal and security reasons, it is non-negotiable to conform with PCI DSS, GDPR, and KYC/AML regulations.

Integrate Secured Payment Gateways:

For seamless transactions, payment gateways have to be trustworthy—ways such as Stripe, PayPal, Razorpay. They should have support for multiple currencies and payment methods.

Strengthen Security with Multi-Layer Protection:

End-to-end encryption, biometric authentication, tokenization, and AI-driven fraud detection should be employed to protect user funds and data.

Design for Intuitive User Experience (UX):

An interface without friction allows users to make payments effortlessly. It should remain clean, responsive, and friendly to both novices and professionals in technology.

Work on MVP Development and Launch:

Start from minimum viable product development to test the main functions and gather feedback on the ideas of development before scaling further.

Test on Performance & Security Rigorously:

Penetration testing, stress testing, and usability testing to weed out vulnerabilities will also ensure performance potential.

Launch, Market, and Monitor:

Deploy the application for both Android and iOS, actively promote it, and monitor the analytics for improvement processes.

Scale With Advanced Features:

Utilize AI-driven insights, digital IDs, cryptocurrency support, and cross-border payments—an application must have these features to stay competitive.

Your mobile wallet has the power to disrupt digital transactions by marrying innovation with digital wallet security measures and becoming an ultimately trustworthy payment experience for the users.

The Future of Payments is in Your Hands

eWallet app development is a necessity today and not a luxury in the fast-paced world of digital economies. Your app will redefine how users interact with their finances if given the right blend of security, usability, and innovation. From stringent security to seamless payment options and designing intuitive user experiences, every step plays a vital role in crafting a reliable and engaging mobile wallet.

At EsferaSoft, we build new solutions that are benchmarked with industry standards while pushing the boundaries in digital payments. Building a new application or even porting an old one; trust, compliance, and user satisfaction are the parameters that will set you apart in the fintech killing field. The future of payments is mobile; call us now at +1 307 2220456 and be a part of it.